Why the annual Form 990 filing is crucial to your nonprofit organization

Each month, TCF processes grant checks from our donors to area nonprofits. We review each organization’s 501(c)(3) status in an online database before mailing these checks and sometimes, we run into a problem.

Your organization’s tax-exempt status has been revoked because the required Form 990 has not been filed.

This means we cannot process the donation and must wait to send the donation until your organization’s status has been renewed. Sometimes our donors decide to give to a different organization because of this.

We know the IRS-required filings can be overwhelming, to say the least. There are so many different forms, and why are they all named by random numbers?

However, keeping up with these forms is crucial for your nonprofit organization to maintain its 501(c)(3) tax-exemption status, which impacts your eligibility for grants, but also for participation in TCF opportunities such as the Great Community Give, the Giving Back Guide, and our competitive grants (opening this summer for the 2025 cycle).

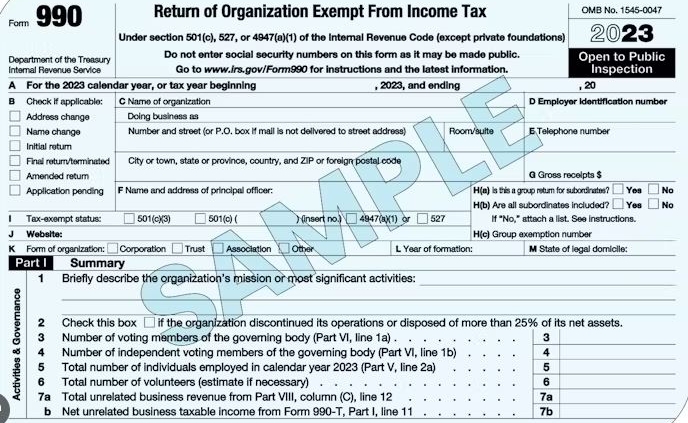

Here’s some more information on the Form 990.

- Organizations with $200,000 or more in gross receipts or total assets of $500,000 or more must fill out a Form 990.

- Organizations with gross receipts under $200,000 and total assets under $500,000 can fill out a 990-EZ, a shorter form of the 990.

- Organizations with $50,000 or less in annual gross receipts can submit a Form 990-N, which can be filled out within minutes online.

Resources

IRS- Stay Exempt (video and written courses on maintaining 501(c)(3) status): https://www.stayexempt.irs.gov/home/existing-organizations/existing-organizations

IRS- Forms, instructions & publications (search engine to find forms like the 990, 8868, etc.): https://www.irs.gov/forms-instructions

IRS- Charities and nonprofits (home page of different resources for NPOs): https://www.irs.gov/charities-and-nonprofits